Contents

ABSTRACT

KEY POINTS FROM KIRA NOODLEMAN'S POV

Why is this the moment for Machine-to-Machine Learning?

- Macro factors have stoked demand for automation, meanwhile, AI advancements mean that machines are ready to be applied to new fields and contexts. “Propelling this category forward is the incontrovertible fact that machines are already winning,” says Noodleman. “With post-Covid supply-chain shocks and labor shortages, we need them more than ever. Coinciding with ML advancements pushing out the frontier of possibilities, we saw a significant increase in the number of devices online in 2020. Enterprise users are exploring more sophisticated tools and interfaces to serve end-customer needs. Further, consider that just 13.3% of US jobs are classified as sedentary desk jobs, per US Bureau of Labor Statistics data. To drive automation outside of an office setting, we need machines that can bridge the physical and digital worlds.”

- Adjacent industries are implementing M2ML tools after their visible successes in manufacturing during the pandemic. “COVID-19 has shown us a glimpse of a more automated, resilient future of work that extends across the supply-chain. While this trend started in manufacturing, it has now moved well beyond into areas like healthcare, R&D, agriculture, waste management, and many more.”

What are the business models that might be attached to this category?

- Software-powered retrofits are easier to implement than new hardware purchases but still expand capabilities, reduce error, and effect cost savings. In leveraging software, retrofits avoid the CapEx and time expenditures of a ground-up hardware solution. “A great example here is Built Robotics, a hydraulics retrofit that makes heavy excavation equipment both autonomous and affordable,” says Noodleman. Other players, including Zinier, Tulip and Parsable, are retrofitting operator-run devices to be more intelligent and avoidant of human procedural errors.

- M2ML can complement human processes, scale manual workflows, and accelerate beneficial feedback loops. “Enterprises can benefit from instant feedback and support via interfaces that harmonize human-computer interaction,” she says. “These tools improve working conditions, but they also enhance the quality and efficiency of processes and outputs. My favorite example of this model is Dusty Robotics, with its robotic tools that make construction more like digitized manufacturing.”

Companies that focus on specific tasks within larger systems are unlocking massive markets.

Kira Noodleman~quoteblock

- Tools that automate high-frequency tasks are generating ROI by targeting mission-critical, yet repetitive processes, such as those around welding, recycling, and healthcare supply-chains. Generalized hardware that addresses a range of tasks is challenging. So, players are finding success by focusing on the high-frequency, repetitive, and narrow tasks that are the low-hanging fruit. “There are a lot of tasks that require only a crab-claw level of accuracy,” she says. “Companies that focus on specific tasks within larger systems are unlocking massive markets.” Examples in this space include applications for welding (Path Robotics), conveyor-system recycling (AMP Robotics), and supply-delivery to hospitals (Diligent Robotics).

- Alternatively, some emerging M2ML-focused teams are designing new paradigms for moving goods across entire supply chains and optimizing networks. “To create step-change efficiencies, sometimes founders must go beyond a single task and focus on bold process-design improvements across an entire ecosystem,” she says.

- “One of our portfolio companies in this space is Warp Logistics, a software-powered docking solution.”

- In residential, there are players focused on modular prefabricated housing: “Periscope Homes is optimizing the entire housing supply chain.”

- In shipping, companies are using dynamic optimization techniques to manage truck-load delivery time. “Here, Baton is cutting trucking ‘detention wait times’ by 50%.”

What are some of the potential roadblocks?

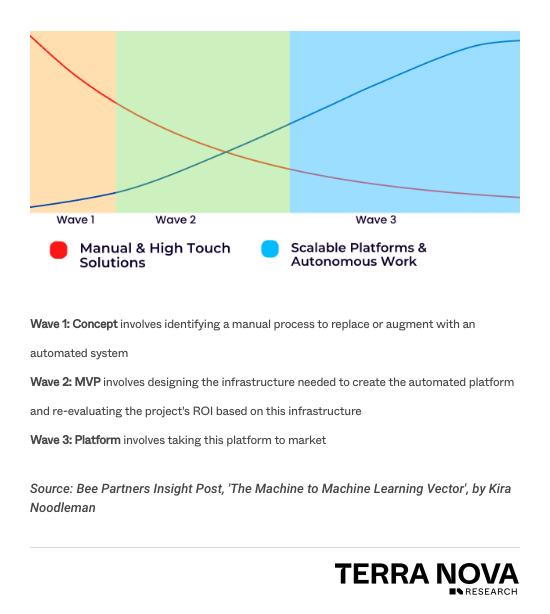

- The three-wave M2ML process is not static and limitations often persist (see visualization, below). Companies that reach performance limits must innovate again for greater efficiency in order to maintain competitive relevance. “Any single iteration only gets a company so far”, says Noodleman.

- Startups face a high risk of getting stuck in the transition from technical feasibility to scalable implementation. “At present, many more M2ML solutions are technically feasible than are financially feasible,” says Noodleman. Once a possible “automatable” process is ID’d, the ROI must be recalibrated to determine that both the hypothetical mechanics and the logistics of the solution will work. “The danger of startups getting stuck is high because of the lengthy iteration timelines paired with an often unclear picture of success. Additionally, sunk-cost psychology may drive deployment of ‘solutions’ that don’t pass the bar of both mechanical and economic proof.”

VISUAL: M2ML PRODUCT CYCLE

Startups that aim to scale M2ML tools face three distinct phases, each of which possess unique obstacles and value-creation potential.

IN THE INVESTOR’S OWN WORDS

We believe that machines will win, and that the timing of human-machine convergence is now.

Machine-to-Machine Learning (M2ML) encompasses physical, digital, and biological domains.

M2ML’s primary objective is to improve upon the limitations of human performance. It must both mirror human features, and increasingly take humans out of the loop, expanding capabilities in speed, precision, and uptime that had not been possible before.

This is made possible through modular components that execute mechanical tasks, inferential tasks, or both. The inferential components learn from other machines that may be real, virtual, or simulated, to improve performance of a system.

M2ML’s value proposition is extensible to a wide scope of new industries. Value is achieved by automating repeatable processes in data-rich domains or “operationalizing” discovery cycles in industries where humans power most of the value. Prime examples for implementation are healthcare and media creation.

M2ML companies must undergo a distinct three-wave cycle: concept, MVP building, and go-to-market. Demonstrating tangible customer ROI differs within each progressive wave.

In Wave 1, we can only theoretically project ROI and design at scale. In Wave 2, we do groundwork, and layer in services, and extrapolate out a solution’s atomic unit of performance. In Wave 3, ROI is measured by an M2ML solution demonstrating superior efficiency, as a platform, rather than via a service model. Unit economics are often contextualized for customers by comparing against the time it would take a human — or your next-best baseline infrastructure — to execute the same task or process at the same quality.

MORE Q&A

Q: What factors are improving the feasibility of M2ML applications within “low-tech” industries?

A: "Newly proliferating data sources like sensors with a reduced physical and energy footprint, or novel types of bioreactors (e.g., carbon fermenters), create opportunities to drastically improve model performance if harnessed well. One way to do that is to integrate the hardware and software stack into a bundled offering that solves customer pain points.

For example, LIDAR implemented with off-the-shelf hardware has enabled the creation of rich spatial maps of diverse environments for forestry, mining, oil and gas, construction, autonomous vehicles, and more.

Additionally, edge software innovations boost device workloads, allow for fast decisions with less information, reduce security risks, and prevent the exponential increase of costs with data roundtripping — all of this even as events proliferate. Companies like Foghorn use event-driven architecture tactics to extract meaningful insights from IoT industrial data flows. Meanwhile, Bee portfolio company Nubix allows IoT applications to run on edge containers, expanding the range of workloads that can be executed on-device."

Q: What are the final steps in scaling a successful platform ?

A: "Wave 3 represents a move towards horizontal models that first focus on a killer application to achieve product-market fit, then scale, and finally cost-effectively extend features into new domains.

Horizontalizing can mean expanding within a large-scale facility, across multiple product domains or industries, or through integrating a new data source. In the case of physical robots, entering Wave 3 often means refactoring the software used in Wave 2 to realize more user-friendly and rapidly deployable solutions.

The ROI focus shifts from a mechanically and economically feasible standalone solution to a synergistic hub of integrated solutions. Wave 3 marks the move towards emphasizing the overall economics of the platform. As network effects kick in, value delivered to the customer increases in a non-linear fashion, translating to higher revenue potential. Additionally, tapping into economies of scale and scope make per-unit costs fall, part of which translates to higher customer value."

WHAT ELSE TO WATCH FOR

As always, hardware commercialization faces challenges. “Adoption cycles in hardware are long and building for interoperability is capital- and time-intensive,” says Noodleman. “This slows down go-to-market velocity for startups with hardware or component-focused products like System-on-Chip (SoC), networking devices, or batteries.

Numerous “as-a-service” models will encourage adoption as they ease implementation for customers, and allow for better and more frequent absorption of customer and market feedback. “Robotics (RaaS), Platform (PaaS), and other ‘as-a-service’ models allow for a shift of CapEx costs to OpEx. The as-a-service business model (within and outside of M2ML) is critical to incentivize quality customer servicing and continuous improvement, which in turn protects against commoditization. These models are attractive, as they align interests and become 'sticky.’”

Watch for companies within life sciences to accelerate product innovation combining manufacturing, M2ML, and life sciences. “Biology teams are harnessing computer science and breaking new ground through DNA synthesis, lab automation, and machine learning,” she says. “These teams are often focused on designing bio-products to meet unique requirements like sustainability, taste, or low unit cost. Companies in this space are typically focused on engineering a bioprocess based on already-proven scientific breakthroughs, but they are pushing the limits of engineering to get to market.”

STARTUPS MENTIONED IN THIS BRIEF

- AMP Robotics, Baton, Built Robotics , Diligent Robotics, Dusty Robotics, Parsable, Path Robotics, Periscope Homes, Tulip, Warp Logistics, Zinier

Acknowledgements

See Kira Noodleman's original article on M2ML here.