Contents

ABSTRACT

🗒️

Pro-competition regulatory agendas and proliferating digital engagement across Latin America will propel fintech companies to disrupt incumbent firms and introduce new products in historically-underserved markets. Clarey Zhu, partner at TCV, sees demand for infrastructure and applications across verticals. Providers must refrain from “one-size-fits-all” models and adopt a localized approach.

KEY POINTS FROM CLAREY ZHU'S POV

Why is this an important market opportunity moving forward?

- Digital markets in Latin America remain woefully under-serviced. “LatAm’s economies form a massive addressable market of more than 650 million people that have historically had little to no financial services penetration,” says Zhu. “With over 70 percent smartphone usage, a rising middle class, and one of the highest internet engagement rates in the world, the region is primed for a digital transformation.” The region's largest economies, Brazil, Mexico and Colombia, remain cash-dominant and have significantly underbanked populations. Incumbent financial institutions within these markets commonly have very low Net Promoter Scores (NPS) and poor user-experience quality.

- Geographically-bespoke fintech products can overcome local hurdles while leveraging overall regulatory tailwinds and market opportunities. Emerging vendors are finding success by taking localized approaches via knowledgeable founders. “LatAm’s biggest markets have pro-competition regulatory agendas such as strong support for open banking, an instant-payment service like PIX in Brazil, license revamping, and more. However, it is a region with many local nuances in the financial systems where global fintech players have not found much success.”

What are some of the business models or applications that might be attached to this category?

- As Latin America is relatively early in tech adoption and digitization, there are opportunities for vendors and new infrastructure across value chains. “There are exciting opportunities across the fintech value chain, especially around consumer digital banking, SMB enablement, office of the CFO, identity and fraud detection, and financial infrastructure,” says Zhu. While some of these areas are earlier on the adoption curve, particularly in B2B, they are all likely to drive big changes in the future.

- Consumer fintech solutions are expanding product offerings and wedging into numerous markets, laying down enabling infrastructure for continued growth. A case study in this respect is NuBank: “We led an investment into Nubank in 2019. Since then, its user base has grown more than 7x to over 70 million, expanding from Brazil to Mexico and Colombia. Its use cases also greatly expanded from credit cards, to bank accounts, personal loans, insurance, investing, SME, crypto, and others,” she says.

What are some of the potential roadblocks?

- Markets can be challenging as companies expand across Portuguese and Spanish-speaking markets and a diverse array of cultural, economic, and regulatory environments. “On the investor side, accordingly, you also need to have a good amount of local knowledge and value-add,” says Zhu. “On another note, I admire how ambitious, informed, and humble many LatAm founders are. We often discuss interesting parallels I see in the US, China, Southeast Asia, and other markets. LatAm founders tend to already know so much about their US and China equivalents.”

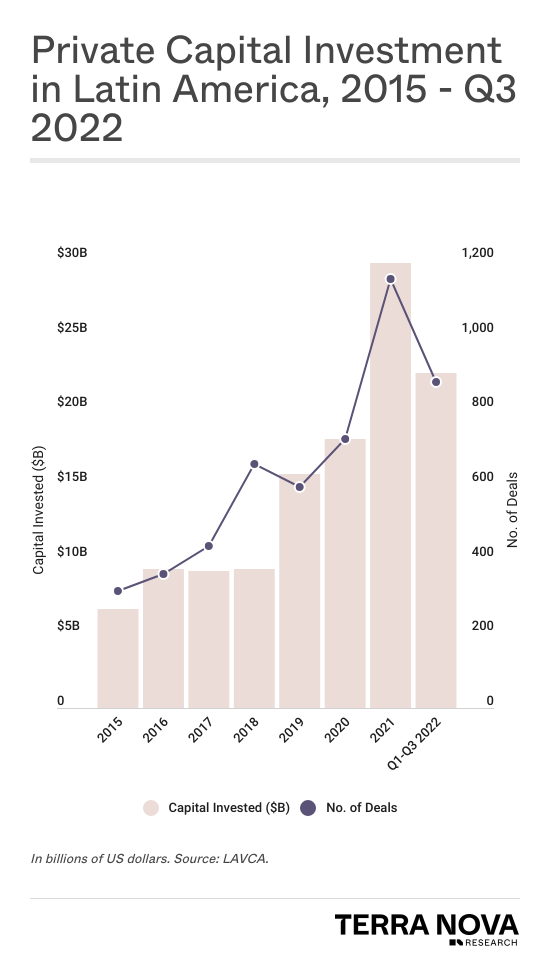

VISUAL: BOOMING INVESTMENT IN LATIN AMERICA’S STARTUPS

The background to the fintech surge is the surge in equity investments into private companies in the region, which hit a record level in 2021, and was still robust in 2022 relative to historical trends.

IN THE INVESTOR’S OWN WORDS

A combination of huge TAM, significant under-penetration of financial services, weak incumbents, strong pro-innovation regulatory support, and important local dynamics make Latin America an exciting geography for fintech innovation.

STARTUPS MENTIONED IN THIS BRIEF

Some text inside div block.